Property Tax California Veteran . California has two separate property tax exemptions: Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. One for veterans and one for disabled veterans. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web california has two separate property tax exemptions: Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. One for veterans and one for disabled veterans.

from www.formsbank.com

Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web california has two separate property tax exemptions: One for veterans and one for disabled veterans. California has two separate property tax exemptions: Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. One for veterans and one for disabled veterans. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited.

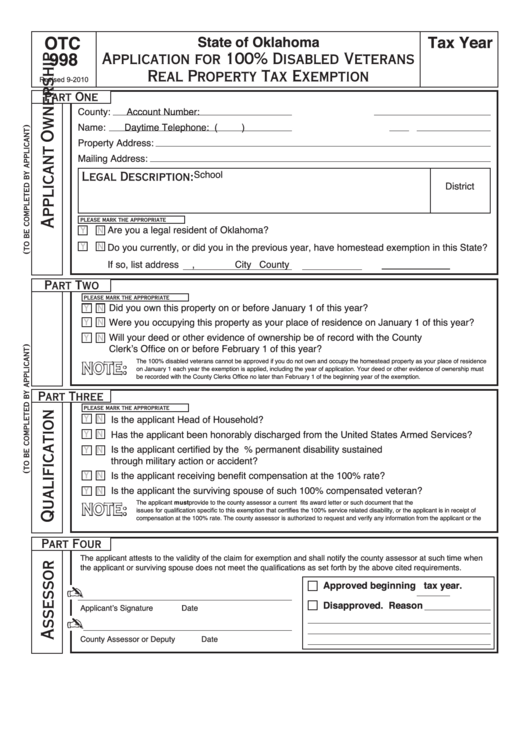

Fillable Form Otc998 Application For 100 Disabled Veterans Real

Property Tax California Veteran One for veterans and one for disabled veterans. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web california has two separate property tax exemptions: Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. California has two separate property tax exemptions: Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. One for veterans and one for disabled veterans. One for veterans and one for disabled veterans. Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a.

From www.formsbank.com

Fillable Form Boe261G (P1) Claim For Disabled Veterans' Property Property Tax California Veteran Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. Web california has two separate property tax exemptions: Web disabled veterans may receive this property tax relief in california by qualifying for. Property Tax California Veteran.

From www.youtube.com

Veteran Property Tax Exemptions Explained YouTube Property Tax California Veteran Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. California has two separate property tax exemptions: Web california has two separate property tax exemptions: One for veterans and. Property Tax California Veteran.

From www.kgw.com

Advocates in Oregon push for property tax relief for disabled veterans Property Tax California Veteran Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. California has two separate property tax exemptions: Web disabled veterans may receive this property tax relief in california by qualifying for either. Property Tax California Veteran.

From www.hfuw.org

Tax exemptions for Service Members, Veterans and their spouses Property Tax California Veteran One for veterans and one for disabled veterans. Web california has two separate property tax exemptions: California has two separate property tax exemptions: Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own. Property Tax California Veteran.

From www.signnow.com

Property Tax Exemption for Veterans for Santa Barbara California 2018 Property Tax California Veteran Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. One for veterans and one for disabled veterans. Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. One for veterans and one for disabled veterans. Web california has two separate. Property Tax California Veteran.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Tax California Veteran Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. Web california. Property Tax California Veteran.

From wilmapshorxo.blob.core.windows.net

Brookline Property Tax Bill Property Tax California Veteran Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. One for veterans and one for disabled veterans. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web the disabled veterans' exemption reduces the property tax liability on the. Property Tax California Veteran.

From www.formsbank.com

Fillable Form Vss Property Tax Deduction By Veteran Or Surviving Property Tax California Veteran Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. One for veterans and one for disabled veterans. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web california has two separate property tax exemptions: California has two separate. Property Tax California Veteran.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal Property Tax California Veteran Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. Web california has two separate property tax exemptions: Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the disabled veterans' exemption reduces the property tax liability on the principal place. Property Tax California Veteran.

From www.youtube.com

2021 California Property Tax Updates and Developments. Prop 13, Prop 19 Property Tax California Veteran California has two separate property tax exemptions: One for veterans and one for disabled veterans. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web california has two separate property tax exemptions: Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption. Property Tax California Veteran.

From www.exemptform.com

Tax Exemption Form For Veterans Property Tax California Veteran One for veterans and one for disabled veterans. Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the california constitution and revenue and taxation code section 205.5 provides a. Property Tax California Veteran.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax California Veteran One for veterans and one for disabled veterans. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web the disabled veterans' exemption reduces the property tax liability on the principal place of residence of qualified veterans. Web the california constitution and revenue and taxation code section 205.5 provides a property. Property Tax California Veteran.

From www.youtube.com

How to apply for your Property Tax Exemption! (100 disabled veterans Property Tax California Veteran Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. California has two separate property tax exemptions: Web a $4,000 exemption for any property that is owned by an eligible. Property Tax California Veteran.

From www.youtube.com

Texas Veteran Benefits Texas Veteran Property Tax Exemption Property Tax California Veteran Web california has two separate property tax exemptions: Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web the veterans' exemption provides exemption of property not to exceed $4,000. Property Tax California Veteran.

From lizbenitez.com

Disabled Veteran Property Tax Relief Liz B. Real Estate Property Tax California Veteran Web california has two separate property tax exemptions: Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. One for veterans and one for disabled veterans. One for veterans and. Property Tax California Veteran.

From www.veteransunited.com

Disabled Veteran Property Tax Exemptions By State and Disability Rating Property Tax California Veteran Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. California has two separate property tax exemptions: Web a $4,000 exemption for any property that is owned by an eligible. Property Tax California Veteran.

From www.youtube.com

Disabled veteran struggles to keep home over property taxes YouTube Property Tax California Veteran Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Web the california constitution and revenue and taxation code section 205.5 provides a property tax exemption for the home of a. Web the veterans' exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited. One. Property Tax California Veteran.

From lao.ca.gov

Understanding California’s Property Taxes Property Tax California Veteran Web a $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. One for veterans and one for disabled veterans. Web disabled veterans may receive this property tax relief in california by qualifying for either the basic or low. Web the california constitution and revenue and taxation code section 205.5 provides a. Property Tax California Veteran.